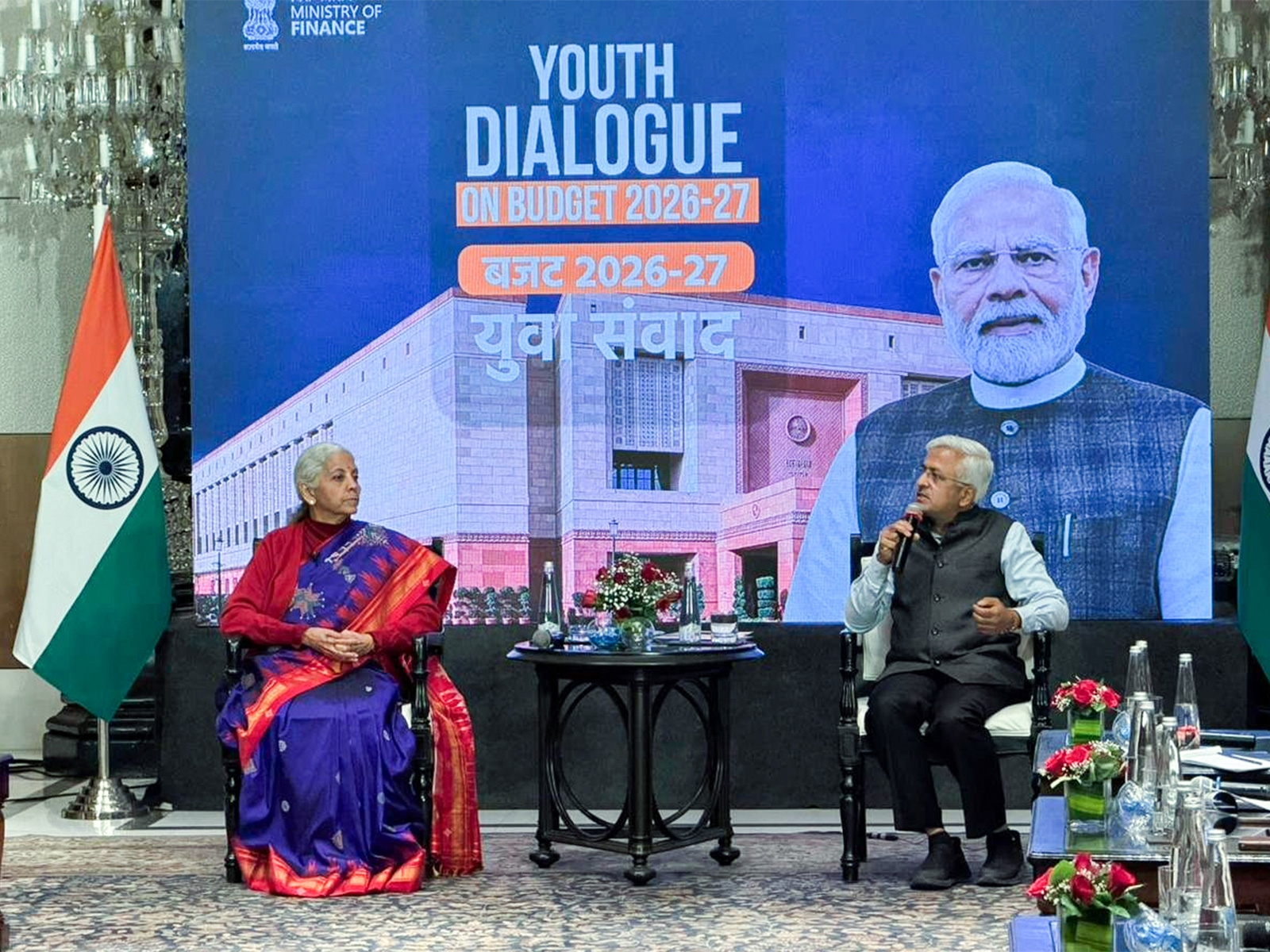

Union Finance minister Nirmala Sitharaman on Saturday introduced new slabs and reduced the tax rate for different slabs for an individual income of up to Rs 15 lakh per annum if a taxpayer opts for foregoing exemptions and deductions.

The new tax regime will be optional and the taxpayers will be given the choice to either remain in the old regime with exemptions and deductions or opt for the new reduced tax rate without those exemptions, she said in the Lok Sabha while unveiling the Budget 2020-21.

Under the proposal, people with an annual income of Rs 5 lakh to Rs 7.5 lakh will have to pay a reduced tax rate of 10 per cent; between Rs 7.5 lakh and Rs 10 lakh 15 per cent; between Rs 10 lakh and 12.5 lakh 20 per cent; between Rs 12.5 lakh and 15 lakh 25 per cent; and above Rs 15 lakh 30 per cent, she said.

The proposal would lead to a revenue sacrifice of Rs 40,000 crore per annum, she added. The minister further said that the new regime will be optional and the people can continue with old regime if they desire so.

Observing that there are about 100 tax exemptions and deductions, she said that 70 of them are being removed in the new simplified tax regime, while the remaining will be reviewed and examined in due course.

"A person earning Rs 15 lakh per annum would be able to save Rs 78,000 in taxes by opting for the new tax regime. The finance minister also proposed deferment of tax payment by employees on employee stock ownership plan (ESOPs) from startups by five years," she said.

New income tax rates

- 5% tax for income between Rs 2.5 and Rs 5 lakh

- 10% tax for income between Rs 5 and Rs 7.5 lakh

- 15% tax for income between 7.5 lakh and 10 lakh

- 20% tax for income between 10 lakh and 12.5 lakh

- 25% tax for income between 12.5 lakh and 15 lakh

- 30% tax for income above 15 lakh

- No income tax for those with taxable income below Rs 2.5 lakh

(With PTI Inputs)

Also Read: Union Budget 2020: Modi govt to amend Companies Act to decriminalise civil offences

Budget 2020: Modi Govt proposes Rs 30,757 Cr for Jammu-Kashmir and Rs 5,958 for Ladakh

First published: 1 February 2020, 14:42 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)