#NotesForMrJaitley 2: Let Raghuram Rajan clean up the bad loan mess

The aim

- In his Budget speech, Finance Minister Arun Jaitley is likely to say his aim is 8% growth

- But Indian banks, which have to fund this growth, might lack the capacity

The mess

- Public sector banks reported gross non-performing assets of Rs 3.14 lakh crore in September 2015

- RBI governor Raghuram Rajan has warned against blind pursuit of growth and asked for action against NPAs

More in the story

- How big is the mess?

- What is the cause such a high amount of NPAs?

- What must Jaitley do?

The Budget for 2016-17 is around the corner and all eyes are now on Finance Minister Arun Jaitley. Should the government spend more, or keep its wallet shut? The global economy wades through crashing commodity prices and unsure policy moves and shaky investors. In the midst of this India has to decide which course to take, to ensure jobs to millions of youth joining the workforce every year. We at Catch bring you a series with a focus on all sections of the population and their requirements from Mr Jaitey's Budget.

***

Finance Minister Arun Jaitley will read out his budget speech on 29 February. This gives us about 3 weeks to speculate what his Budget this year is likely to contain.

In all likelihood, he would set a target of above 8% growth for the next financial year. But for that, the country needs to have a sound banking sector that could provide capital for funding investments which, in turn, will yield such ambitious growth to the country.

Read- #NotesForMrJaitley: how to make this year's budget more farmer friendly

Do Indian banks have the capacity to fund Jaitley's ambitions? The Indian banking sector is dominated by public sector banks (PSBs) that account for 70% of the market share reported.

These PSBs reported gross non-performing assets of Rs 3.14 lakh crore at the end of September 2015, which was a 25.19% increase from Rs 2.5 lakh crore at the same time in the previous year.

Non-performing assets are the loans that have gone bad due to non-payment of interest or the principal amount by the borrower.

This figure of gross NPAs account for 68% of the planned expenditure of the government for financial year 2015-16.

In September 2015, PSBs reported gross NPAs of Rs 3.14 lakh crore, up 25.19% from the previous year

However, even this gigantic figure is just the tip of the iceberg. If we include the share of stressed assets, which have been reported at Rs 4 lakh crore of which the PSBs account for an estimated Rs 2.8 lakh crore, the numbers will become much bigger than what the government plans to spend.

Banks do not generate capital of their own. They rely on the interest of loans to extend loans to corporates and the government sector. The greater the quantum of bad loans, the lesser would be the banking sector's capacity to invest in the economy.

What ails Indian banks?

The NPAs as a percentage of total advances that stood at 12% in 2001 were brought down to 2.4% by 2008.

However, with the global economic recession hitting global demand, the then UPA government decided to give a push to the Indian economy by aggressively spending on the infrastructure sector.

Also read: Should Jaitley loosen the purse strings? Here's what economists think

While this sustained the Indian growth momentum and the Indian economy stood out amidst other economies of the world, it also forced the Indian banking sector to lend aggressively to the infrastructure sector.

According to an analysis by RBI, "a number of regulatory measures and concessions were provided to banks including take out financing, relaxed asset classification norms and enhanced exposure ceilings for infrastructural lending".

Today, 8 out of 10 most indebted companies in India with a combined debt of 5.83 lakh crore, are from the infrastructure sector.

Most of these companies have not been able to either operationalise their projects or have not made enough profits to repay their loans.

The figure for Gross NPAs is 68% of the govt's planned expenditure for financial year 2015-16

Indian banks have allowed a restructuring of such infrastructure sector loans under the 5/25 schemes, that allows moratorium on payments for a few years in the hope that those infrastructure projects will generate profits sometime in future and the companies would be able to repay it.

Nobody knows whether that will happen or not.

RBI governor Raghuram Rajan recently criticised the high growth ambitions of the government by giving the example of the Brazilian economy in his CD Deshmukh lecture at National Council of Applied Economic Research.

Photo: Punit Paranjpe/ AFP Photo

"Only a few years ago, the world was applauding the country's (Brazil) thriving democracy, its robust economic growth, and the enormous strides it was making in reducing inequality. It grew at 7.6% in 2010 and had discovered huge oil reserves, which the then President Lula likened to 'winning a lottery ticket'. Yet the country shrank by 3.8% last year, and its debt got downgraded to junk. Growth will be no better this year. What went wrong?" asked Rajan.

Read more: Put money into people's hands Mr Jaitley. It will work

"Paradoxical as it may seem, Brazil tried to grow too fast. The 7.6% came on the back of substantial stimulus after the global financial crisis. In an attempt to keep growth high, The New York Times says the central bank was pressed to reduce interest rates, fuelling a credit spree that overburdened customers are now struggling to repay.

"Further, Brazil's government-funded development bank hugely increased subsidised loans to corporations. Certain industries were favoured with tax breaks while price controls were imposed on gasoline and electricity, causing huge losses in public sector firms," he explained.

What Rajan explained in the context of Brazil, could well apply to India as well.

Rajan further added "It is possible to grow too fast with substantial stimulus, as we did in 2010 and 2011, only to pay the price in higher inflation, higher deficits, and lower growth in 2013 and 2014."

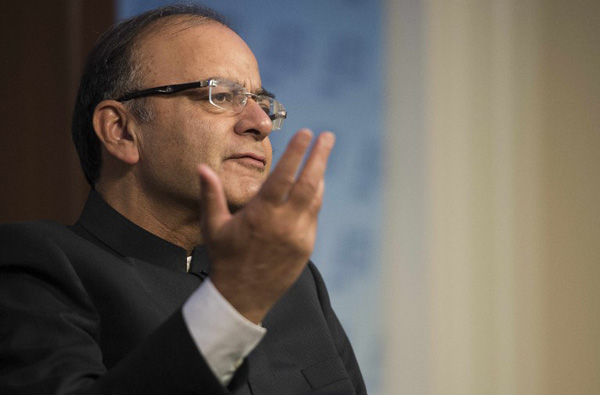

Photo: Jim Watson/ AFP Photo

A lesson for Jaitley from his predecessor P Chidambram would be to assess whether India has the capacity to grow at 8% in the first place. If yes, where will the money come from? And do companies have the capacity to repay those loans?

Absence of a sound credit appraisal system

When the government pushes banks to lend frantically to support its ambitious growth targets, the banks shut their eyes towards the need for a sound credit appraisal system. This is what happened in the Indian banking sector.

In 2014, Dr KC Chakrabarty, the then Deputy Governor of the RBI, had said in one of his lectures, "A very disturbing fact which hits us is the quality of equity that has been brought in by the promoters. The banks, to put it mildly, have been very lackadaisical in the credit appraisals. Most of the time it is debt raised elsewhere by the promoter, either in the holding company or in a Special Purpose Vehicle, which is used to fund their portion of the equity.

Effectively, promoters do not have any 'skin' in the game and they are least bothered whether or not the projects see the light of the day. The 'source' and 'quality' of equity brought in by the promoters is a major element which the banks would have to carefully examine in their credit appraisal going forward."

RBI Governor Raghuram Rajan has warned the govt against the blind pursuit of high growth

It does not come as a surprise that corporate chieftains like Vijay Mallya celebrate their birthdays worth crores of rupees, despite owing billions of rupees to Indian banks.

If promoters lost their hard earned equity to banks, they would be more responsible towards the projects for which they took loans.

Can the banking sector come out of this mess?

The answer lies in how much pressure the government puts on the defaulters to repay their loans.

Vishwas Utagi, general secretary of Bank Employees Federation (AIBEA), says "there are 7,265 wilful defaulters as per the government data who owe Rs 64,000 crore to the banks. They must be forced to repay their loans."

Utagi also says that the list of wilful defaulters should be expanded and even the top business tycoons' names should be made public so that there is public pressure on them to repay their money.

However, the RBI governor himself has been reluctant to make the names of loan defaulters public.

But the question one needs to ask is, if a common borrower who defaults on loan can be shamed by the banks for missing his EMI payments, why shouldn't big businessmen face the same treatment?

Fudging the numbers

To cover up the increasing NPAs , Indian banks have used methods like Corporate Debt Restructuring (CDR) and Strategic Debt Restructuring (SDR) that allow them to only postpone the recognition of bad loans on their balance sheets.

While the RBI has cracked the whip on the CDR method by ensuring all new CDRs from April 2015 would be considered bad loans, it is yet to take a call on the SDR method.

Read more- Shock and awe: the top 10 indebted companies in India

The SDR method was introduced by the RBI to help banks recover their loans by taking control of the distressed listed companies.

The scheme requires a consortium of lenders (as a stressed company has taken loan from various banks) to coordinate and take over a 51% equity in the company.

However, within 18 months of the takeover, the banks have to find a suitable buyer for the asset that is willing to run the company and help banks recover their money.

Can SDR succeed?

Ankur Kedia, Associate Director, Deal at Pricewaterhouse Coopers says "Chances of success of SDR are limited as implantation of SDR in the first place requires the cooperation of existing management/ promoter. Implementation of SDR may require shareholders approval, amendment of charter document and increase of authorised share capital. Banks have hurriedly approved SDR in a few cases to avoid an NPA situation but are now contemplating not implementing the same".

Kedia further says that "it is better to accept that loans have gone bad instead of trying to delay their recovery".

We hope that Jaitley will do a fair analysis of the growth that India can achieve and allow Rajan to treat the disease of NPAs without much interference.

Edited by Aditya Menon

More in Catch:

No sweet dish outs, please: Patna HC cracks down on politicians nominated as MLCs

Uber just changed its logo and branding. Cue the Facebook-esque backlash

First published: 5 February 2016, 6:19 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)