Subscribed to Atal Pension Yojana yet? Know how much to invest in the scheme

Atal Pension Yojana, one of the social security schemes for the unorganised sector, launched by the Government. The pension scheme is basically for the Indian citizens and aims to provide a defined pension between Rs. 1,000 to Rs. 5,000 per month, depending on the contribution and its period.

The scheme allows people between the age of 18 and 40 years of age to invest for up to 20 years to earn a fixed montly pension of the amount mentioned above after a retirement age 60 years, according to Pension Fund Regulatory and Development Authority (PFRDA).

How to apply for APY?

On line Application : Convenient Paperless process

- Existing account holders can click the ‘Apply Now’ button on their banking portal (Suppose HDFC bank) which will redirect to NSDL site. Select the name of your bank from the list.

- Input your Aadhaar No and generate OTP. Input OTP when received.

- Give personal and nominee details, select pension amount and frequency.

- E-sign the application form to confirm for enrolment.

Application at a Branch

- Existing account holders can approach your bank branch to subscribe to APY

- Provide the Bank A/c number to the bank staff who will help to enroll for APY.

- Give personal and nominee details, pension amount and frequency.

- Sign the form to confirm for enrolment

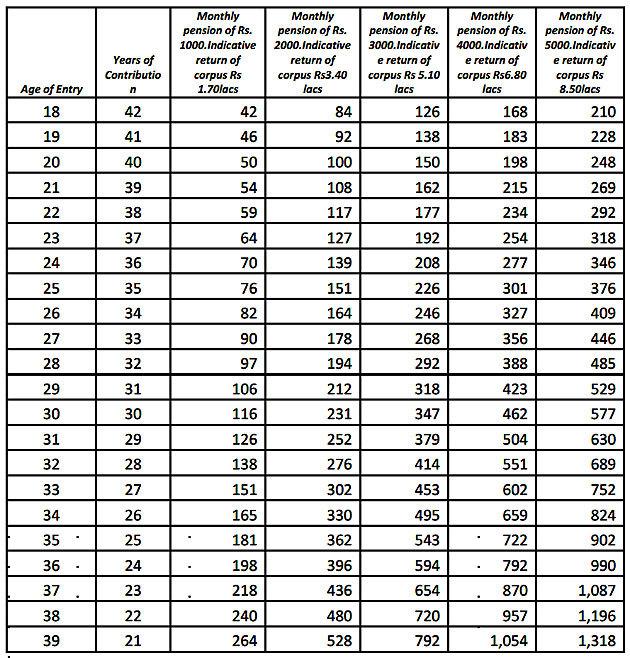

How much to contribute?

18-year-old APY subscribers need to contribute Rs. 42-Rs. 210 per month. The contribution amount increases with increase of age. The contribution is deducted from the subscriber's bank account through an auto debit facility. The contribution amount depends on the age at which one enrolls in the pension scheme. The auto withdrawal/debit facility is optional.

The minimum contribution period is 20 years and the contributions under the pension enjoy same tax benefits as NPS (National Pension System).

First published: 22 November 2018, 13:19 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)