Trump's stunning victory has caused short-term panic in the markets

While the world over is still processing the aftermath of the brutal US elections that wrapped up in the early hours of Wednesday, 9 November, the stock markets, at least for now, seem to have given a unanimously decisive decision.

Democratic nominee Hillary Clinton has been duelling with Republican candidate Donald Trump for a good six months now and it all came to fore during election day. The power was in the hands of the citizens of the United States of America. What was witnessed was a complete shocker to everyone across the world tuning in. In a year that had Brexit - Britan's referendum to leave the European Union - no one would have seen the Trump machine coming.

Clinton may have won the popular vote but it was Trump who ran away with the elections, crushing all pre-poll predictions the world over had given. After an ugly vote in which the European Union was rejected by Britishers, no one thought Americans could do one worse.

"Trump is vulgarity unbounded, a knowledge-free national leader who will not only set markets tumbling but will strike fear into the hearts of the vulnerable, the weak, and, above all, the many varieties of Other whom he has so deeply insulted. The African-American Other. The Hispanic Other. The female Other. The Jewish and Muslim Other," writes David Remnick in The New Yorker.

That's just it. Trump is striking fear not just in those who trade stocks daily but also a large chunk of the population. While the jury may be out on what exactly the cirizens make of his stunning victory, the markets have taken a decisive turn for the worse.

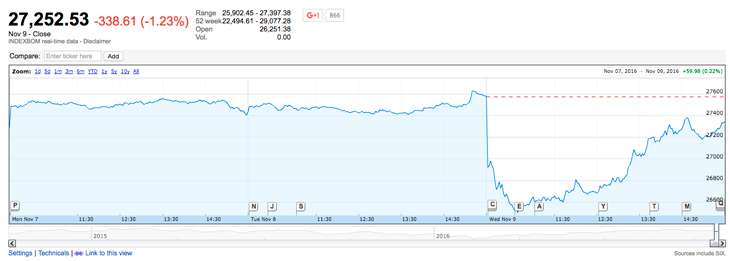

Over here in India, it gets even worse. Prime Minister Narendra Modi threw a curve ball at the nation just as the polls in the United States were opening. He made a grand speech just before the 9 o'clock news broadcast to announce his new monetary policy where the country would do away with Rs 500 and Rs 1,000 notes to curb corruption and black money. It was a double jolt. Not only did he take the limelight away from Trump, as he does with a lot of people, he always gave investors a tougher time. Not only did they have to follow the US elections and the impending doom, but they also had to take into consideration the implications of this new monetary policy.

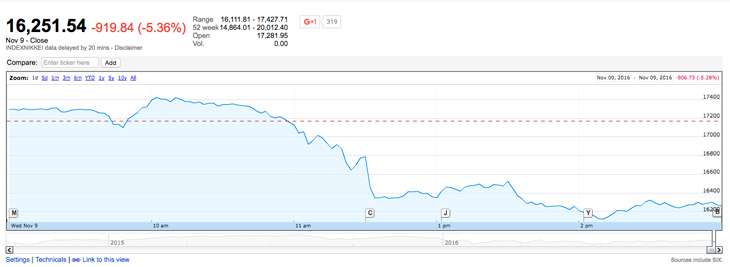

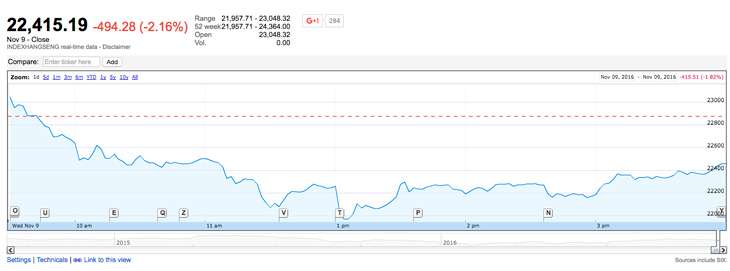

With the earliest polls closing as early as 7 PM on the East Coast, the only markets that were opened/about to open were the Asian ones. Along with India's NSE and BSE Sensex, Japan's Nikkei 225, Hong Kong's Hang Seng and South Korea's Kospi.

Asian Markets

Trump's protectionist rhetoric was seen as a bad sign for Asia. In the past, Trump has talked about new tarrifs on Chinese imports, and punishing those companies that outsource their jobs. Most traders today felt some sort of belief. It was like Brexit all over again. For some, it was a level below that. Trump's talked about building a wall in front of Mexico and banning immigrants from entering the country.

It all depends on how investors process a reality show host that is now leader of one of the most powerful nations on this Earth.

Japan's Nikkei, usually a stronghold of the Asian markets, fell 5.4%.

Hong Kong's Hang Seng finished 2.2% lower.

South Korea's Kospi was down 2.7%.

India though, as mentioned above had a double jolt. Investors dealing with the fallout of the currency ban and the doom that America has caused. At one point, the BSE Sensex was down about 1,600 points. The markets smartly recovered with both ending just about 4% down at the end of trading on 9 November. The BSE Sensex was down 338.6 points while the Nifty was down 111.55.

While the there may be a short-term knee-jerk reaction to the markets in India, the long term impact will not be negative. The markets had factored in a Hillary Clinton win but no one, in their right mind, ever thought Don ald Trump was in striking distance of becoming President and hence, in the past few weeks, they hadn't at all priced a Republican victory into their trading.

What might be hit most are the pharma stocks that have an exposure to the US market.

European Markets

While Trump has declared war on China and called it a 'currency manipulator' there are other reasons why the stock markets are on their downfall. His fiscal policies are also a concern. The worry is that they will add significantly to the US budget deficit and US public debt. This will lead to higher US interest rates in the long-term, something which the markets will reject.

European stock markets may have tumbled at their opening on Wednesday, but they too staged a recovery, mid-session, with some turning positive.

In the initial hour or so, London's FTSE 100 fell as much as 1.87%, Frankfurt's DAX 30 nosedived 2.9% and Paris' CAC 40 was in the red by 2.8%.

"This is another black swan for European stocks - despite Brexit, markets were still not prepared for a Trump win and stocks will bear the biggest brunt of it," City Index analyst Ken Odeluga told AFP. "It is a long-term negative for global growth because of the protectionist instincts of President Donald Trump.

It seems Trump's calm victory speech was the reason as to why the European stock markets didn't tank.

Here's a look at the European stocks at the opening of the markets in the United States.

FTSE 100

Frankfurt's DAX 30

Paris' CAC 40

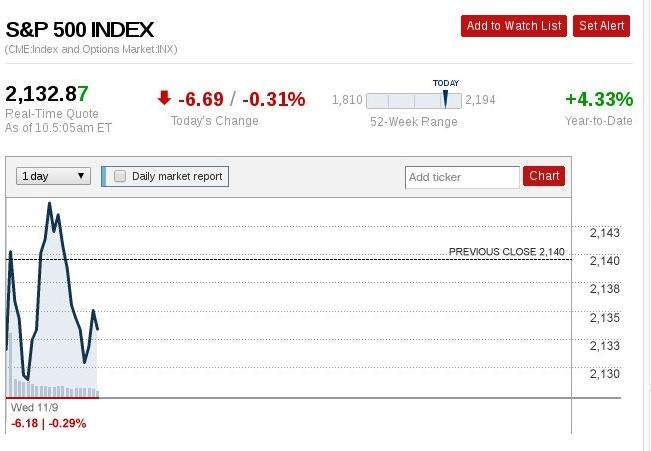

United States market

One more reason why the markets are beginning to bleed now that Trump will be at the helm is his tirade against US Federal Reserve Chair Janet Yellen. Furthermore his support from Rand Paul and other Republicans to 'audit the Fed'.

Upon coming to power, Trump will have the ability to fill the two vacancies left at the Federal Reserve Board.

Futures in the United States stock market opened only at 6 PM Eastern Standard Time. At this point, Trump's victory wasn't decisive but investors were looking at Florida for signs of hope of a Clinton victory. With the lead changing every couple of minutes, the futures swung by many a point.

Clinton was seen as more open to international trade than Donald Trump and this also added to why the futures fell.

US markets were choppy. The Dow Jones Industrial Average opened in the red and was volatile in the first half an hour of trading.

Remember that back in June, after Brexit happened, US stocks suffered a two-day drop of 5.6%. The stock markets had recovered 10 trading days later.

"The Trump-driven tumult, however, may keep the uncertainty level high in markets for a bit longer," David Joy, chief market strategist at Ameriprise Financial, told USA Today.

Here's how the Dow Jones Industrial and S&P 500 looked after the opening bell.

Mexican Peso

What was hit the most was the Mexican Peso. There are still major concerns about the impact of a Trump presidency on Mexico. The Mexican Peso fell more than 13% overnight to its worst levels in two decades. Mexico is expected to fall further on Trump's pledges to build a wall along the Mexican border with the country and renegotiation of the two nations' NAFTA free trade agreement.

"The peso recovered as "investors expected action by the central bank to support the currency". Trump's threats to rip up a free trade agreement with Mexico and to tax money sent home by migrants to pay for building a wall on the southern U.S. border have made the peso particularly vulnerable to events in the race for the White House.

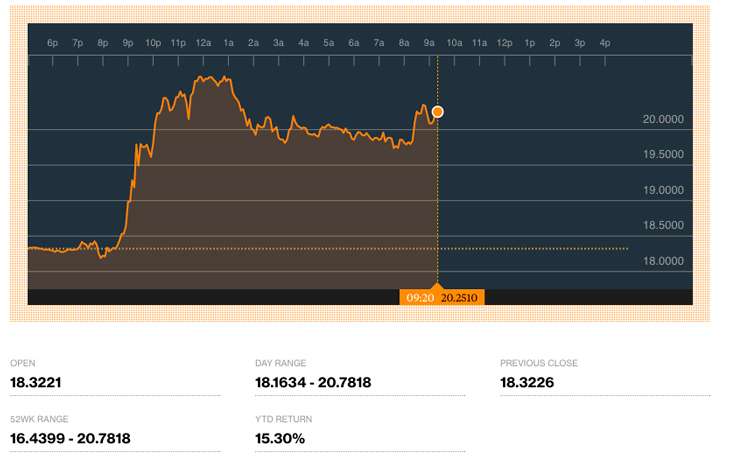

"Mexico's currency weakened by more than 13 percent in after hours and Asian trading on Wednesday, breaking past 20 pesos per dollar, which would be its biggest fall since the 1994 Tequila Crisis," write Michael O'Boyle and Noe Torres in Reuters (http://www.reuters.com/article/uk-mexico-peso-idUSKBN1340L4).

It remains to be seen, what happens from now till 20 January. Whatever the case, expect the markets to remain volatile and investors on knife-edge. Let's just hope investors don't dwell upon a Trump presidency for long. After all, we do have four years with the man at the helm.

First published: 9 November 2016, 9:09 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)