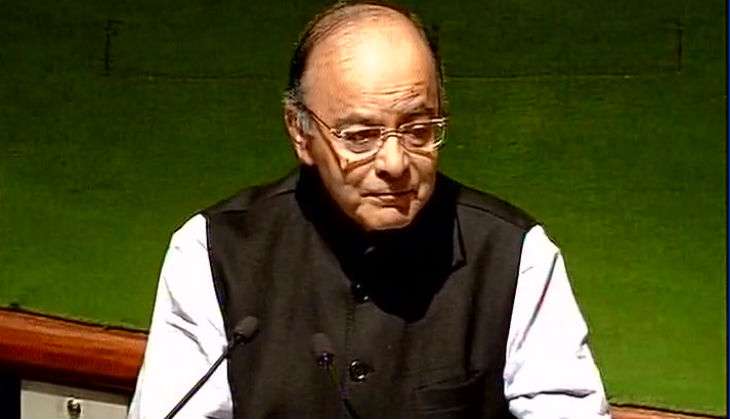

The government, on 28 November, proposed to levy a total tax, penalty and surcharge of 50% on the amount deposited post demonetisation while higher taxes and stiffer penalty of up to 85% await those who don't disclose but are caught.

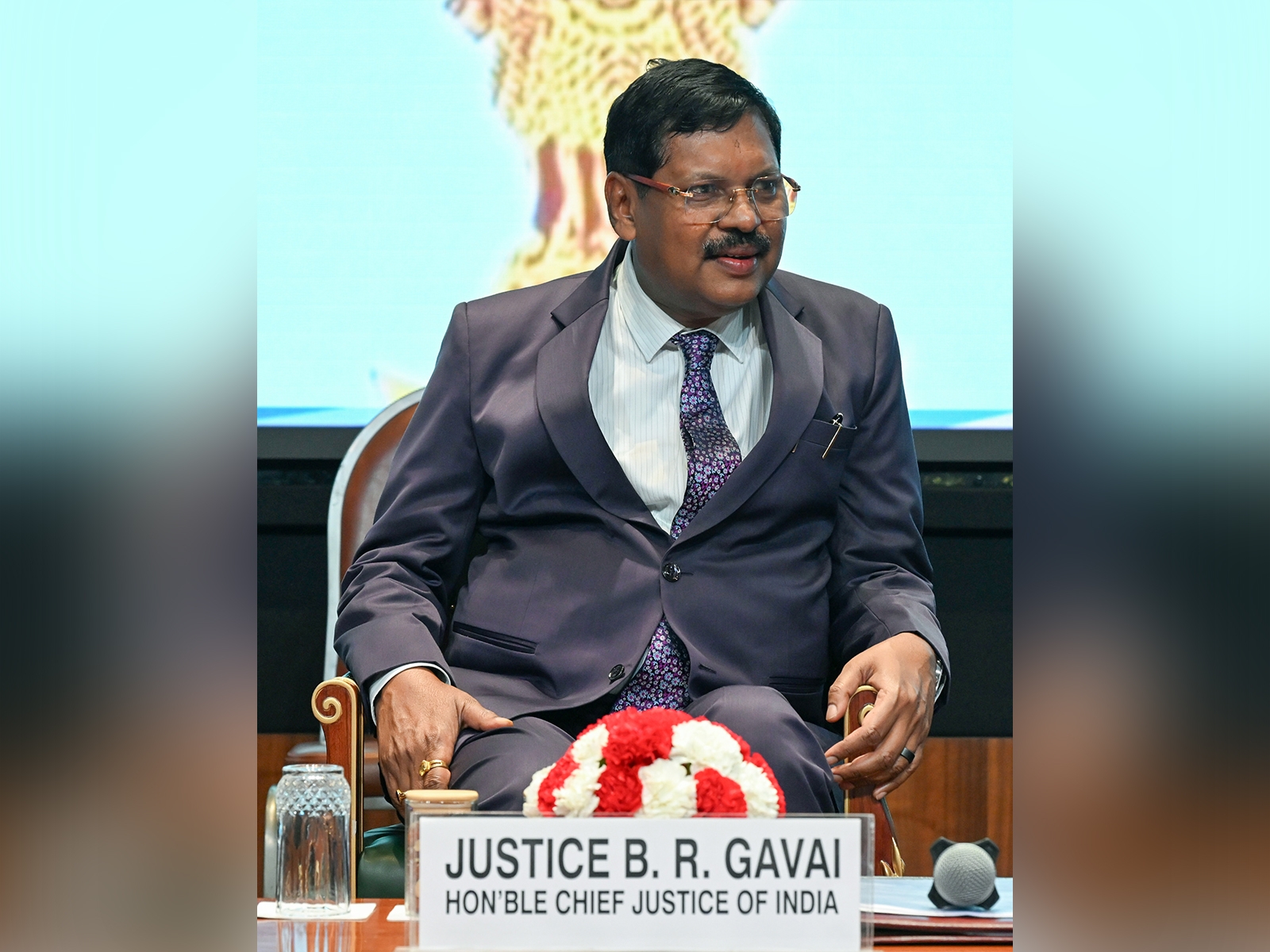

Nearly three weeks after Prime Minister Narendra Modi announced junking high denomination 500 and 1000 rupee notes, Finance Minister Arun Jaitley introduced a bill to amend the Income Tax law which also provides for black money declarants to mandatorily deposit of 25% of the amount disclosed in the anti-poverty scheme without interest and a four-year lock-in period.

Those who choose to declare their ill-gotten wealth stashed till now in banned 500 and 1000 rupee notes under the Pradhan Mantri Garib Kalyan Yojana 2016, will have to pay a tax at the rate of 30% of the undisclosed income.

Additionally, a 10% penalty will be levied on the undisclosed income and surcharge called PMGK Cess at the rate of 33% of tax (33% of 30%).

Further, the declarants have to deposit 25% of the undisclosed income in a scheme to be notified by the government in consultation with the Reserve Bank of India (RBI).

The money from the scheme would be used for projects in irrigation, housing, toilets, infrastructure, primary education, primary health and livelihood so that there is justice and equality, said the Statement of Objects and Reasons of the Bill.

For those who continue to hold onto undisclosed cash and are caught, existing provisions of the Income Tax law will be amended to provide for a flat 60% tax plus a surcharge of 25% of tax (15 %), which will amount a levy of 75%.

Besides, if the assessing officer decides he can charge a 10% penalty in addition to the 75% tax.

--PTI

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)