Why interest rates on small savings schemes always give middle class a raw deal

The burden

- Govt has reduced interest rates on small savings schemes, citing lower inflation

- But it seldom increases interest rates when inflation is high

- Linking interest rates to the market is based on convenience, not principle

More in the story

- Why lower inflation, fall in crude prices isn\'t helping the people

- What\'s the government\'s justification?

- Who are the real beneficiaries?

Over the last two years, the NDA government has made sure that the middle and lower middle classes have borne the brunt of the shortfall in revenue.

First, it kept on increasing duties on the price of diesel and petrol to make sure that the middle class doesn't benefit from the fall in crude oil prices in the international market.

And now, it has decided to hit the middle class where it hurts the most - the interest rate on small savings schemes.

Also read - Govt to tax interest on EPF: what's the point of saving for retirement?

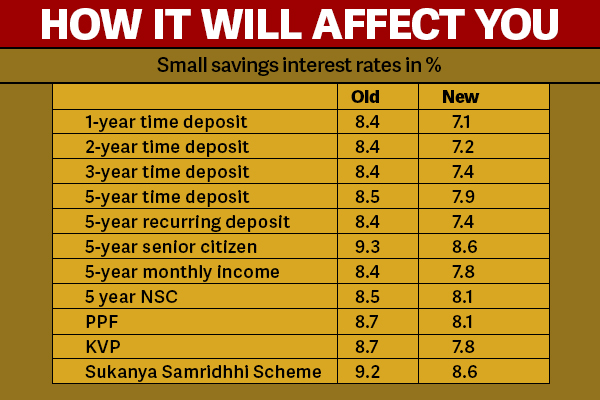

Under pressure from banks and the corporate lobby, the government has reduced the interest rates on small savings schemes like National Savings Certificates (NSC), Public Provident Fund (PPF) and Post Office Time Deposit Accounts by up to 130 basis points.

This means the middle class that had just won the battle by forcing the government to roll back its decision to tax the 60% of the withdrawal amount on the Employee Provident Fund, will have to pay much more in the form of losses in annual savings.

The argument being given by the government is that since the inflation in the country has come down - it is currently below 6% - so should the rate of interest on small savings. The justification given is that the basic purpose of small savings schemes is to provide a safe avenue to middle class investors to make their money grow.

Govt has reduced interest rates on small savings schemes like PPF & NSC by up to 130 basis points

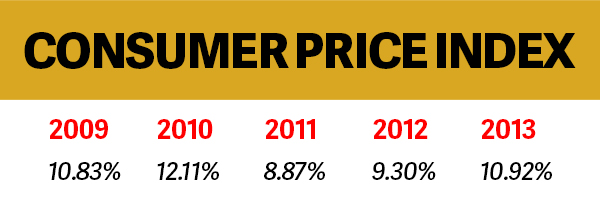

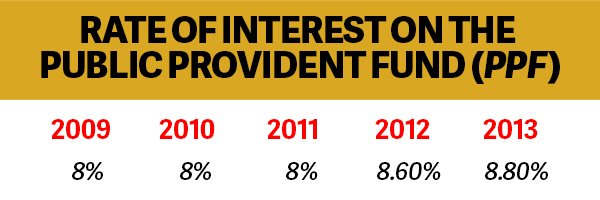

However, if the government actually believes in keeping the interest rates linked to the rate of inflation, then why, between 2009 and 2013, did the government not give a higher-than-inflation interest rate? This rate is also known as the real interest rate, which is the difference between the inflation rate and the interest on investments.

For example if the average rate of inflation in a given year is 10% and the rate of interest given by the government on savings is 9%, the real rate of interest for the investor is -1%.

Now let's look at the Consumer price index between 2009 and 2013.

And here's the rate of interest on the public provident fund (PPF) in the same period.

This means that the government was giving investors a negative rate of return. Most people did not question the negative rate of interest due to their ignorance about the loss of money or because they simply did not trust other avenues of investment like the stock market and mutual funds given their volatility.

All the other small savings schemes along with bank fixed deposits during this period gave more or less the same kind of negative or minutely positive returns on investment.

Market-linked interest rate based on convenience

So now the question is: when the investors are in a position to earn some real interest rate due to low inflation in the country, why does the government want to eat into that benefit?

Governments (UPA as well as NDA) have shown a penchant for making sectors market-linked (a term used for de-regulating the sector) when it is against the interest of consumers and controlling it when it can actually benefit them.

When the price of crude oil was above $100 per barrel in the international market, the UPA government had de-regulated the price of petrol and undertook gradual increase in the price of diesel to pass on the higher cost of products to the consumers.

But when crude oil have been coming down since June 2014, the NDA has chosen to increase taxes on petroleum products, pocketing the additional income instead of providing relief to consumers.

A similar trick has been played with small savings schemes in the name of market-linked economics.

Will the NDA government give it in writing that in future if the inflation goes up to 12% that they will increase the interest rates on the small savings schemes? Are they ready to give 15% interest on PPF or NSC?

Or will the champions of market-linked-economics then start arguing the opposite? An argument that is often given is that the government needs to invest in the infrastructure sector, hence the money cannot be handed out to people in the form of higher interest rates.

Middle class forced govt to roll back EPF tax. But their savings will take a hit anyway

Free-market economists as well as editors of financial papers are praising the government's decision to reduce the interest rate on small savings schemes with an argument that the move will allow banks to bring down interest rates on loans, which will help the people of the country.

They hail this as one of the biggest reforms of the Modi government.

But the questions is, how many beneficiaries of the small savings schemes have taken a home loan or a car loan?

Small savings schemes are an avenue of investment for middle and lower middle class people in the country. An auto-driver, a fruit vendor, a rickshaw puller, all of them save a part of their income to invest in post office savings schemes. They cannot and will not invest in share markets or mutual funds. They do not want to buy insurance products as most insurance schemes are long term investments, which are of little immediate use to economically backward classes.

The ultimate benefit of reduced rate of interest - if at all - will go to the corporates who have already gobbled up trillions of rupees from the Indian banking system and are not willing to repay their loans. (Read Bank Non-performing Assets & Vijay Mallya).

A common man will always be the victim of this market-linked economy of convenience.

More in Catch - Mallya case: clamour growing for wilful default to be made criminal offence

Take bank bosses to task for bad loan crisis, says Vishwas Utagi

First published: 20 March 2016, 8:37 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)