Why a rockstar PM & RBI governor couldn't prevent a Sensex crash

The crash

- The Indian stock market witnessed a massive crash on Monday. Sensex crashed by 1625 points

- This is the result of a meltdown in the Chinese economy following the devaluation of the yuan

- India\'s stock market withstood the Greek crisis. But it hasn\'t been able to insulate itself this time

The way out

- RBI Governor Raghuram Rajan says India can fight the meltdown. But this will not be easy

- What is needed is a massive attempt by the RBI

- Modi\' promise of Achhe Din had created optimism in the market. But nothing changed on the ground

- Modi and Rajan will have to address the fundamentals

Finally, the dams have burst and there is a bloodbath on Dalal Street. China has done what the Greece crisis could not do to the Indian markets.

The contagion of a financial meltdown in China has spread within no time thanks to the fact that global equity markets are inter-connected via electronic networks.

There was a time not so long ago, when the Indian markets were protected from global contagions because we had strict capital controls and the locals decided where Dalal Street was going rather than the Foreign Institutional Investor who now calls the shots.

Damage control

Predictably, RBI Governor Raghuram Rajan is out fighting the markets with eloquent words saying that we have the reserves to fight the meltdown. In the latter parts of 2007, Hank Paulson was doing the same to prop up the US markets which had started to suffer from the ill effects of a sub-prime lending binge.

However, as any serious market participant will tell you, mere words of a Central Bank head cannot halt a financial meltdown. The Bank of Japan had tried to talk the dollar up against the ever rising Yen in the late 1980s but the market used to shrug off whatever he said and carry on regardless.

Only a massive and concerted Central Bank intervention can halt the market's tide as happened on 3 January 1990 when 14 Central Banks started dumping US Dollars just as the New York market opened.

However, when the financial contagion is widespread as it is now, even concerted Central Bank intervention is unlikely to help stop the contagion.

Just think about it. If the RBI was to spend US$ 10 billion a day on shoring up the Indian Rupee, it would be out of ammunition in 30 days because all we have are US$ 300 billion of foreign exchange reserves. Those reserves can help with balance of payments and trade related imbalances but they cannot halt capital flows.

Only a massive and concerted intervention by the RBI can halt the market's slide

The economic problems in China had been the subject of discussion for a long time in the western press. In India and other parts of the world we may have empty buildings but China had empty cities. Its factories worked on wafer thin margins to keep people employed.

However, once the dams burst, there was no way of containing the contagion. So the Chinese government tried the "beggar thy neighbour trick" by devaluing the Yuan not once but twice in quick succession. It did not help as Capital took flight to the safer havens of US Treasuries.

Achhe Din not an easy task

Let us take a closer look at the Indian markets and analyse what had been happening. Ever since, Narendra Modi won the elections in May 2014, the markets rose rapidly in anticipation of Achhe Din. Well, Achhe Din cannot come on the back of lofty rhetoric alone. Achhe Din require visionary leadership combined with implementation of serious reforms and changes. In India, the ground reality remains as terrible as ever.

Events in Madison Square Garden or in other global cities where Prime Minister was feted as a rock star may create a feel good euphoria but such things are ephemeral.

India has a rock star Prime Minister combined with a rock star Central Bank governor. So why has the market gone into a dramatic slump? The main reason is that not much has changed on the ground.

The macro-economic picture of India as painted at Davos and in Washington DC is at serious odds with the micro-economic ground reality of India. Here even India's capital city, its financial capital along and its Silicon Valley do not have the infrastructure to meet the needs of their citizens. Hype and rhetoric can buoy up the financial markets only for a short while.

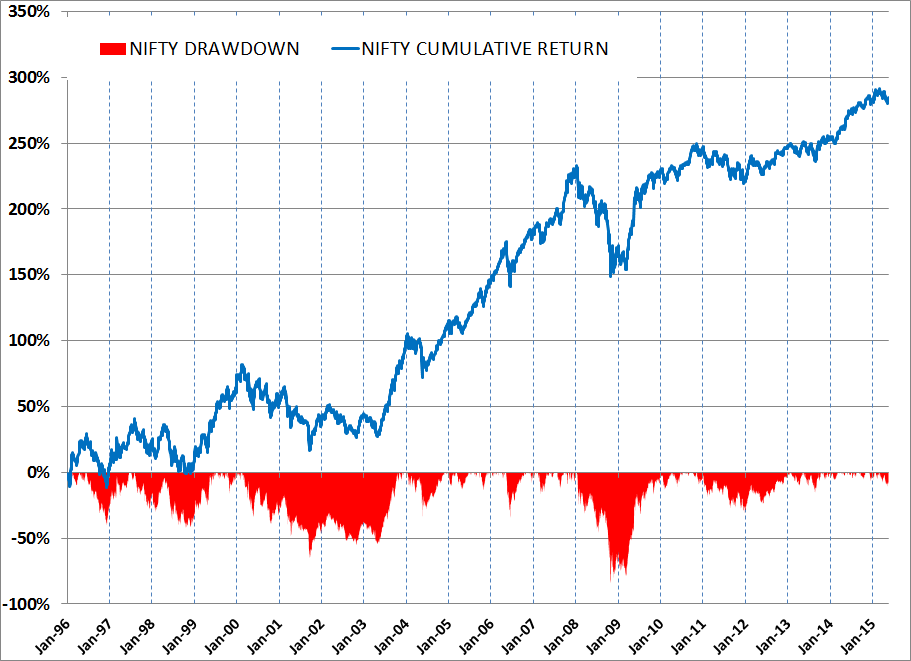

A close look at the graph below shows that the Indian markets have been beset by serious drawdowns since 1996. One of them took place as recently as 2008 when the Nifty Index fell nearly 85% from its peak.

The current fall of the Nifty from a peak of 9,000 to around 7,850 today is a mere 12.8%. It is most likely the tip of the proverbial iceberg. More pain is on its way before we can even begin dreaming about Achhe Din.

First published: 24 August 2015, 6:57 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)

_in_Assams_Dibrugarh_(Photo_257977_1600x1200.jpg)