Quarterly returns to cheaper Khakra: Govt takes steps to address GST anger

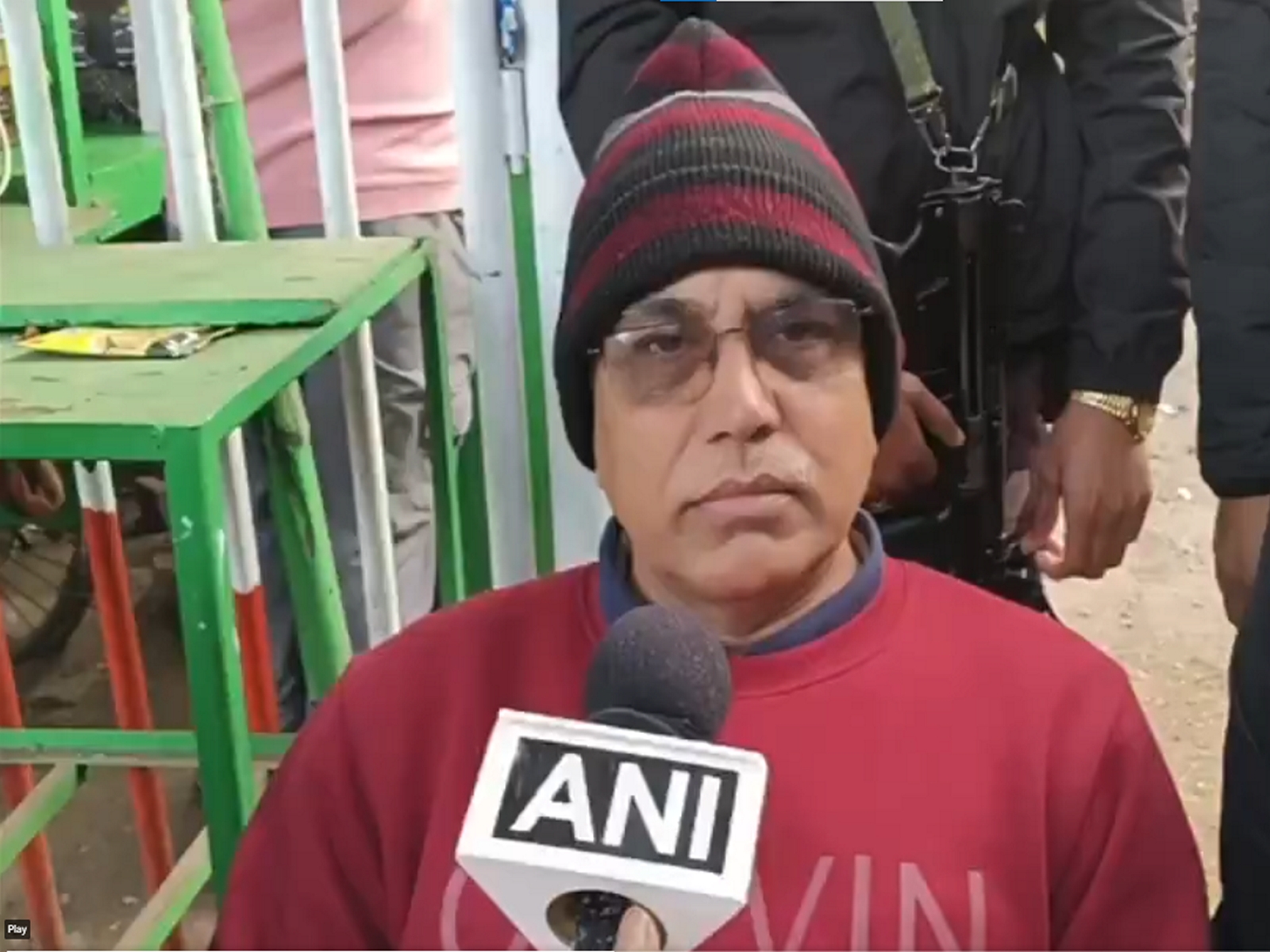

After facing flak from traders for introducing a complex Goods and Services Tax regime in the country, the government on Friday came up with a slew of measures to ease their pain.

The government also made an attempt to bring down the prices of certain commodities that earlier fell in the higher tax slab.

Here are the details:

- In his media briefing after a day-long meeting with the GST council, finance minister Arun Jaitley said, “Non-composition scheme taxpayers with turnover up to Rs 1.5 crore can now file quarterly returns.

- The limit for turnover in compensation scheme has now been raised from Rs 75 lakh to Rs 1 crore.

- To make the procedure of refund for exporters, the government will provide each entity with an e-wallet that would receive direct refunds from the government.

- Exporters will also be exempt from Integrated GST for next six months.

- Those in the business of trading with revenue of up to Rs 1 crore a year will pay a flat tax of 1%;

- Manufacturers in eligible for composite scheme will now pay 2% tax

- Restaurants will pay a tax of 5% under composite scheme

- Non-branded Ayurvedic medicines will attract a tax of 5%

- Khakra will now attract 5% GST

- Paper will now attract a tax of 5%

- Namkeen (confectionery) will attract 5% tax

- Service providers with revenue below Rs 20 lakh have been exempted from IGST as well.

Pros and cons

The SME sector has been negatively impacted by the GST since July this year. It is believed that a large part of job losses over the past months have happened in the SME sector as they found it difficult to deal with a tax regime that required traders to focus more on tax filing than doing business.

The move of increasing the threshold limit of the composition scheme to Rs 1 crore, from Rs 75 lakh, will definitely allow many more traders to be part of a scheme that allows simple compliance. The composition scheme enables businesses to pay tax at a flat rate of 1% for traders, 2% for manufacturers and 5% for restaurants without input credits.

While traders have been given respite in, those traders who choose to file their returns quarterly may continue to face problems as their input tax credit will be delayed by three months leading to a shortfall in working capital. However, the government has kept the window open for filing monthly returns for those who want to get early access to input tax credit, as well.

Will it boost the economy?

A major problem with the GST has been its multiple tax rates. So the government's decision to reduce taxes on certain products does not change that situation. In a Kirana (grocery) shop the small trader will continue to face the trouble of calculating different tax rates on different items he sells. Apart from this the process of filing returns on GST will continue to be troublesome for a long time to come. And this keeps the problems of the small traders where they were, albeit, with cheaper confectionery ahead of Diwali.

First published: 6 October 2017, 22:54 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)