GST's anti-profiteering rules could be be misused severely. Here's how

There was hardly a company that did not cheer the passing of the Goods and Services Tax in the Parliament last year.

But as the date of enactment of the new centralised tax regime comes close there is a provision in the law that is threatening the business community in the country.

The GST law, once applicable from 1 July, would come into force with an anti-profiteering clause, which could be used to debar a company from doing business in case it is found not passing on the benefits accrued due to GST to the customer.

An anti-profiteering authority will be set up with the powers of assessing whether a company passed on lower prices on account of the GST to customers.

According to news reports, a complaint will be first verified by a standing committee of officers. Based on the merit of the case, it will be investigated by the director general of safeguards. The authority will then take a call on the quantum of punishment, which, at its extreme, will deregister the license of a company. The entire process will be complete within eight months.

While industry stakeholders have called the clause draconian, the government has assured the stakeholders that the anti-profiteering provisions would be used as a last resort by the government.

What was the need of anti-profiteering clause?

A big concern associated with GST has been that it will fuel inflation in the country. In most countries where GST has been implemented, the first two years have seen huge inflation, leading to protests from the public.

In 2015, Malaysia saw mass protests from people demanding a role back of the newly enacted GST law that contributed to increasing the cost of living in the country.

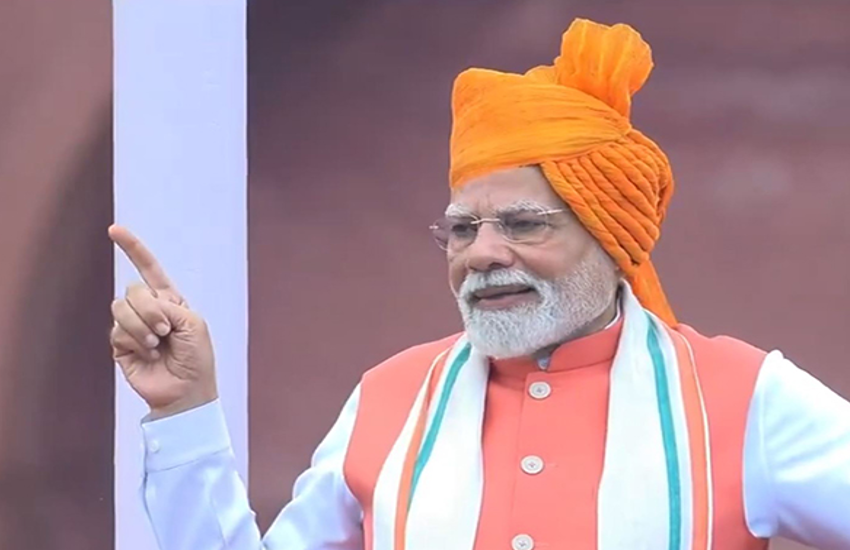

The NDA government is enacting the GST just about two years before it goes for elections for a second term. If at the time of election, GST fuels inflation in the country, it will give the Opposition a chance to organise anti-government sentiment in the country. Therefore, the government wants to leave no stone unturned to ensure that the benefits of lower taxes on goods are effectively passed on to the customers.

Why does the industry fear it?

Any law that gives the power to an inspector/authority to debar a company from doing business can be misused. The pre-liberalisation era was full of such stories when inspectors used their authority to demand bribes from the companies in lieu of favourable reports on the laws against hoarding of goods in the country. The industry fears that, the new authority will have sweeping powers that could be misused against a company.

There is also lack of clarity on what would be the margin that a company would be able to make on a particular product. For example, if a company used to sell soap at Rs 10 with an X amount of input cost, post GST, if its input cost goes up , how much margin would the company be able to earn on the sale of each unit.

Such a scenario will make it impossible for the companies to undertake price increases for their products.

Can such a law actually keep inflation down?

The only way to keep the prices low in a free market is through increased competition. In the telecom sector, the tariffs have been falling without the existence of any anti-profiteering law. In sectors like drugs and medicines, the government controls the price of essential drugs through categorisation. But even there, the price control is applicable on a limited number of drugs.

But by creating anti-profiteering authority the government wants to control the price of each and every commodity in the country. Will it be successful in its mission, without hurting the business sentiment in the country, is anybody's guess.

First published: 21 June 2017, 19:54 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)