Modi govt's black money amnesty scheme a spectacular flop

The scheme

- The govt launched a scheme to bring back black money on 1 July

- Those who had parked assets abroad could declare them, and pay tax and a penalty on them

- Those who declared their assets wouldn\'t face prosecution

The failure

- In the run up to the Lok Sabha elections, Modi had declared that Rs 80 lakh crore black money was stashed abroad

- On 15 August this year, he said the government had managed to retrieve Rs 6,500 crore

- The final figure under the scheme is just Rs 3,770 crore

More in the story

- Inherent flaws in the Modi government\'s scheme

- Expert analysis of the failure of the scheme

After all the noise the Narendra Modi government made over bringing back black money, it has only managed to get Rs 3,770 crore in its three-month long amnesty scheme.

This is not even loose change compared to the figure - Rs 80 lakh crore - that Modi had promised to retrieve in 100 days after coming to power, in the run up to the 2014 Lok Sabha elections. BJP president and Modi's close aide Amit Shah had later dismissed the PM's words as an 'idiom'.

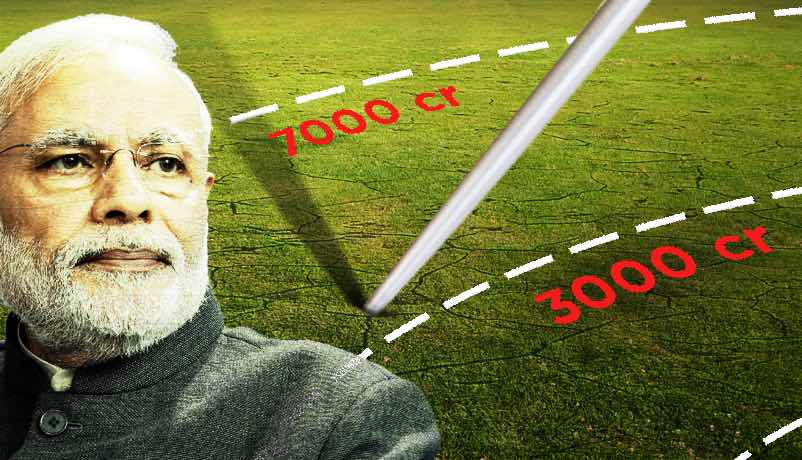

More importantly, this figure is about half of what Modi had claimed in his address to the nation on 15 August.

"A total of 6,500 crore of undisclosed foreign assets have been declared under the compliance window of the new law and the drive [to retrieve undeclared money] would continue despite its 'side effects'," Modi had said in his speech.

The rupee hasn't depreciated so alarmingly in the last month and a half, so either Modi was inflating the figures or the retrieved black-money has leaked through the government coffers.

But before asking why Modi's amnesty scheme failed so spectacularly, it is important to look at the scheme itself.

Inherently flawed

The government opened the compliance window to declare black money on 1 July. This allowed Indians to declare their illegal assets or income parked abroad during the three-month long window, with a promise to not launch prosecution.

Those who disclosed their assets by 30 September would allowed to pay the tax and penalty by 31 December.

But why didn't people declare their black money? Why did this scheme fail?

The government imposed a 60% tax on the asset holder's peak income. Which meant that if a person's undeclared asses in an account abroad peaked at Rs 100 crore, they would have to pay Rs 60 crore and avoid being caught by the agencies later on.

The govt has only managed to get Rs 3,770 crore - about half what the PM had declared on 15 August

But what if a person had parked Rs 1,000 or Rs 5,000 crore abroad? Some economic analysts say that for those with large amounts of wealth stashed abroad, who possibly also had means to conceal it, parting with more than half their assets wouldn't seem sensible.

"The thinking among one section of people was obviously that it doesn't make financial sense to part with more than half your wealth. It obviously would have seemed quite a steep amount to literally purchase peace of mind. The other problem was that it was felt that this wasn't a proper amnesty scheme either," said Hemal Mehta, senior director, Deloitte in India.

Declaring the income one had so far concealed from the government meant exemption from some IT acts and immediate prosecution, but what if the government launched retrospective legal action against the tax offenders?

"See, after all, you're disclosing your identity. What if the government begins to probe deeper into your financial deals and begins harassing you? Even if the present government is favourably disposed towards those who disclose the income, what happens if a subsequent government decides to launch proceedings against all those who disclose undeclared assets now?" Mehta said.

A previous scheme

There was one bold scheme to retrieve black money that UPA-2 Finance Minister P Chidambaram had launched - Voluntary Disclosure of Income Scheme (VDIS). With low tax rates and promise of no prosecution, the scheme was an instant success. Around Rs 10,000 crore of taxes were collected through this scheme.

But the scheme soon ran into legal troubles.

A petition was filed in the Supreme Court, stating that such a practice was discriminatory against those who paid their taxes regularly and dutifully. Those who parked their black money outside were being awarded for their misdemeanor through such schemes, was the argument. At the end of it, the government had to give an undertaking to the Supreme Court that the VDIS was the last of its kind, and it would not bring about such schemes in future.

Not serious enough

Another important question is whether the government was serious in its attempt to retrieve black money?

Arun Kumar, former professor at Jawaharlal Nehru University (JNU), and author of 'The Black Economy in India' said the government's attempt at trying to get the money back was purely symbolic.

"There are no stringent provisions to catch tax evaders. No successful prosecution has been launched against anyone with black money stashed abroad. The HSBC list with 628 names was released some time back. How many prosecutions were initiated?" he asked.

Kumar said financial transactions that led a person to conceal money were so convoluted that it makes the government's work impossible, unless it works on the issue with firm resolve.

"This amnesty scheme was a means to convey to people that the government was serious about acting on black money, without taking any real action. The fact is that the government has no idea how much illegal money and assets are parked abroad. Unless specific provisions are announced and people are punished and sent behind bars, no one will take this seriously."

First published: 2 October 2015, 2:05 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](http://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](http://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)