The story behind Rs 11,000-Crore PNB Scam

India's one of the biggest banks fraud came to limelight recently that amounts to 11,300 Crore approximately. With India's one of the richest man involved along with Punjab National Bank and multiple other banks.

With much more to unearth, this is what we know about the case so far.

What exactly happened

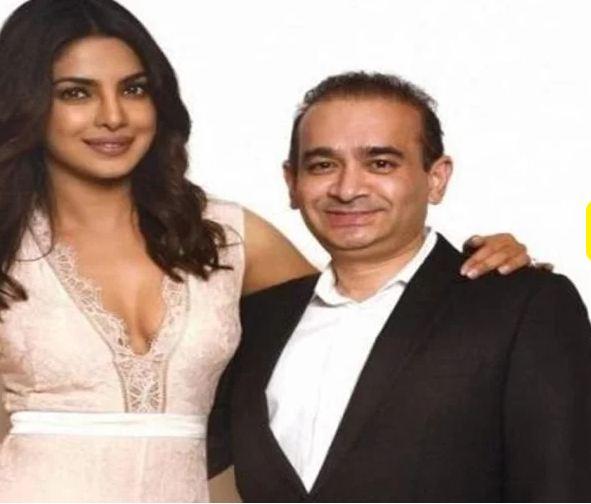

This scam dates 2011 with Nirav Modi (who has dressed Hollywood and Bollywood actors including Kate Winslet and Priyanka Chopra) approaching PNB for an opening letter of credit (LC) for import of rough stones.

According to LC, a common banking tool, Punjab National Bank (PNB) had to pay the suppliers of the diamond firm the hefty amount and later the recover the money from the Modi firm.

As per the bank claims, Modi's company used fake PNB guarantees worth dollar1.8 billion to get loans from the overseas branches of Indian banks.

Fake Letter of Undertaking (LoU)

As if now it has come to notice that PNB employees issued fake LoUs. Because of this fake letter, foreign Indian bank branches which include Axis and Allahabad gave dollar loans to PNB.

These foreign currencies were transferred to PNB’s foreign account(Nostro) that existed in that particular funding bank. Later the fund was transferred to some overseas parties.

It is to be noted that the transfer took place based on the fake LoUs. The whole SWIFT network was misused.

In using SWIFT network, one has to have a login Id endorsed by a supervisor and the complete process is completed when the bank confirms and validates the details.

The strangest thing about the whole episode is that while SWIFT transaction was taking place, it was never recorded in bank’s core system.

Behind the scam

According to the complaint filled in Central Bureau of Investigation (CBI), a case is filled against Nirav Modi, a jeweler who's dressed Hollywood and Bollywood actors including Kate Winslet and Priyanka Chopra. A complaint has been filed against Mehul Choksi's Gitanjali Group of companies.

PNB alleges that Modi and Choksi worked with a former PNB employee, Gokulnath Shetty, who was posted at a PNB branch in Mumbai from where the fraud originated. Shetty was a deputy general manager in the foreign-exchange department looking after import payments.

How did it come to light

Last month when representatives from Modi's companies approached PNB for another loan they were declined.

The firm contested that they had availed this facility in past as well. However, the bank had no such record and it was then that the bank discovered the fake letters of undertaking and filed a complaint alleging a $44 million fraud.

After two weeks of initial complain another complaint was registered worth dollar 1.8 billion.

First published: 16 February 2018, 17:03 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)

_in_Assams_Dibrugarh_(Photo_257977_1600x1200.jpg)