Economic Survey prescription for Jaitley: Note ban hurting GDP growth, so spend wisely

The Economic Survey presented before Parliament Tuesday has a clear message for Finance Minister Arun Jaitley: spend the fiscal windfall wisely.

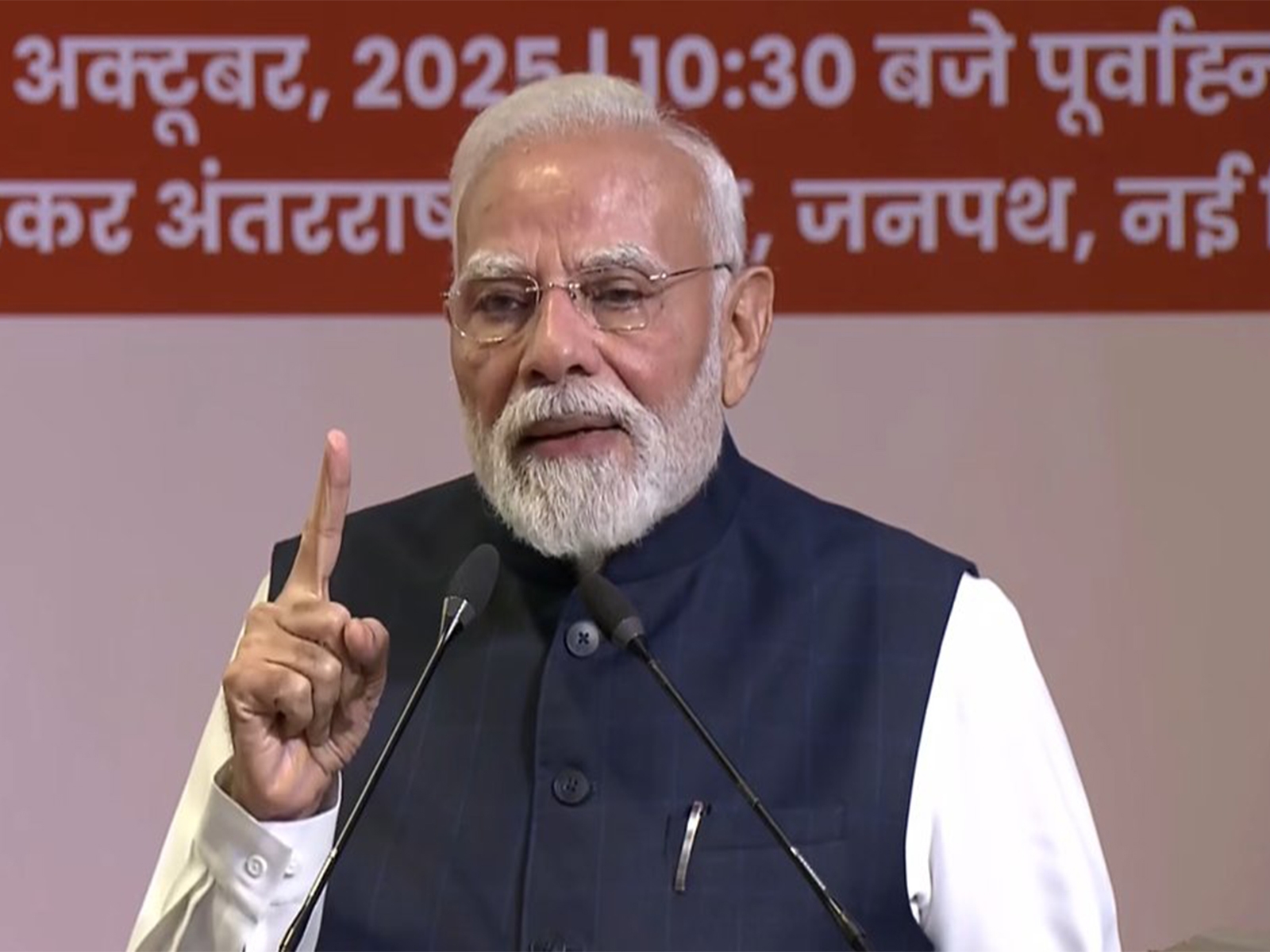

"The objective analysis of country's economy", as Chief Economic Advisor Arvind Subramaniam describes the survey, is optimistic about India's growth potential and discusses at length how policies of the Narendra Modi government are in line with achieving higher growth.

At the same time, it lists out concerns and explains what public policy must not do.

Before looking at the survey as an indicator of what would be in Budget 2017-18, to be presented Wednesday, let's explore one key aspect that has been discussed in detail.

Also Read: Budget 2017: Railway Safety tax to be introduced in Union Budget

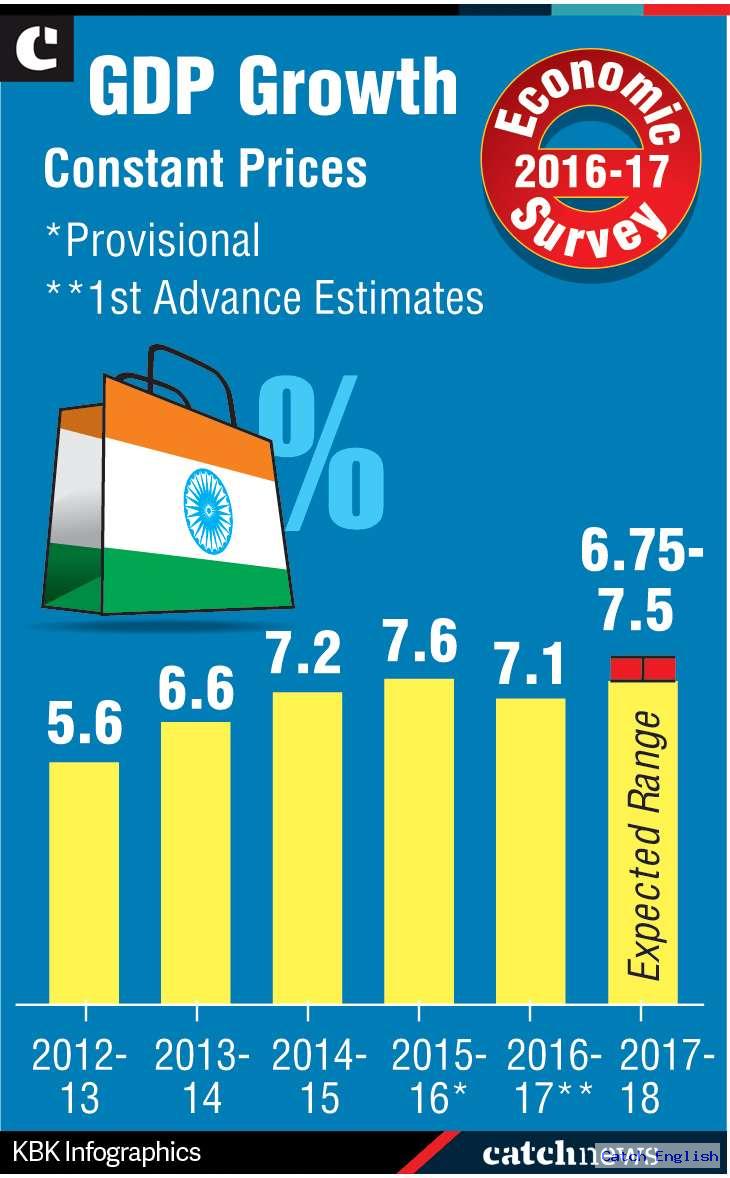

The survey concedes that demonetisation will reduce the growth rate of India's Gross Domestic Product, which for the current fiscal is projected at 7.1%, down from 7.6% in the previous financial year.

The data is in line with the advance estimates of the Central Statistical Organisation. However, the bigger point highlighted by the survey is that the after-effects of the note ban will continue to slow down the economy even in the next fiscal; for 2017-18, the GDP is estimated to grow in the range of 6.75-7.5%.

"It would be reasonable to conclude that real GDP and economic activity has been affected adversely, but temporarily, by demonetisation. The question is: how much? The short answer is between 0.25% and 0.5% relative to the baseline of about 7%," the survey states. It, however, predicts that once the cash supply stabilises, likely by end-March 2017, the economy would revert to normal, perhaps even see a bounce in real GDP growth to 6.75%-7.5% in 2017-18.

As he prepares to present the budget, Jaitley faces several fundamental questions, the blueprint for addressing which lies there in the Economic Survey.

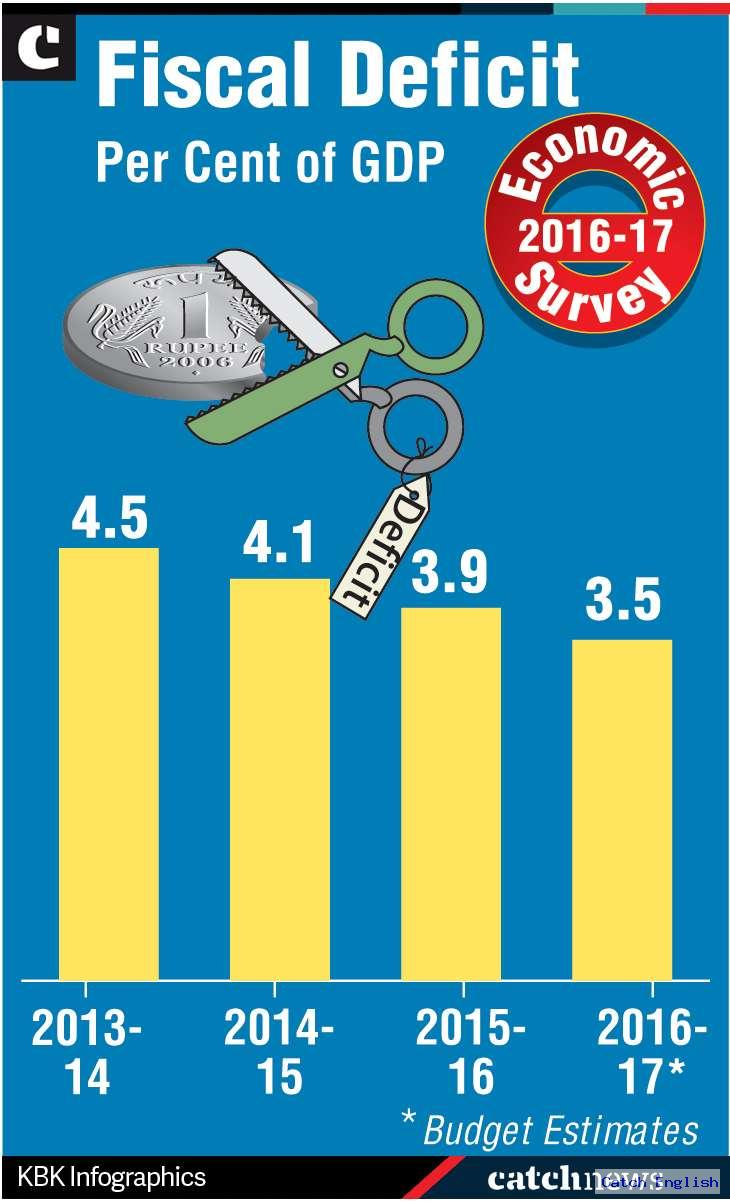

While India's economic growth is slowing, not the least because of declining private investment, there is a need for higher government spending. It has been argued that by putting aside its rigid fiscal deficit target for another year, India can achieve higher growth just as the US and many European countries are witnessing. But the survey insists that India's growth story is different.

"Advanced countries have moved away from these principles toward greater fiscal activism, giving counter-cyclical policies much more of a role and giving correspondingly less weight toward curbing the debt stock.

"But India's experience has taught the opposite lessons. It has reaffirmed the need for rules to contain fiscal deficits, because of the proclivity to spend during booms and undertake stimulus during downturns. In short, it has underscored the fundamental validity of the fiscal policy principles set out in the FRBM," the survey states, referring to the Fiscal Responsibility and Budget Management Act, 2003.

The survey, however, argues for reviewing the FRBM Act. Coincidentally, a report on reviewing the fiscal deficit targets was submitted by the NK Singh Committee to the finance ministry just last week.

Also Read: Notebandi & politics: What is the problem with demonetisation?

Given the challenging economic scenario, however, it is unlikely Jaitley will give up fiscal prudence. We should, therefore, not expect any big schemes or fiscal stimulus to counter the ills of demonetisation.

Commenting on government schemes for the poor and underprivileged, the survey recommends a Universal Basic Income, but adds that it should not be implemented before reviewing existing schemes.

"The existing government programmes suffer from poor targeting. One radical idea to consider is the provision of a universal basic income. But another more modest proposal worth embracing is procedural: a standstill on new government programmes, a commitment to assess every new programme only if it can be shown to demonstrably address the limitations of an existing one that is similar to the proposed one; and a commitment to evaluate and phase down existing programmes that are not serving their purpose," the survey suggests.

The survey also addresses the matter of potential fiscal windfall to the government from demonetisation and unearthing of black money. "One key question will be the use of the fiscal windfall (comprising the un-returned cash and additional receipts under the PMGKY) which is still uncertain.

Since the windfall to the public sector is both one-off and a wealth gain not an income gain, it should be deployed to strengthening the government's balance sheet rather than being used for government consumption, especially in the form of programmes that create permanent entitlements."

To support its argument for prudent spending, the survey lists the threats to India's economic growth - increasing protectionism in advanced economies, implementation of the GST, rising crude oil prices, among others.

"The transition to the GST is so complicated from an administrative and technology perspective that revenue collection will take some time to reach full potential.

"Combined with the government's commitment to compensating the states for any shortfall in their own GST collections, the outlook must be cautious with respect to revenue collections. The fiscal gains from implementing the GST and demonetisation, while almost certain to occur, will probably take time to be fully realised," the survey concludes.

Also Read: FM Arun Jaitley's Budget 2017-18 may look to soften note ban woes by tax relief

First published: 14 February 2017, 7:08 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)