#BlackMonday: the bloodbath isn't over yet. Here's what's going on

Slippery markets

- The Indian stock market fell the most on Monday since 2008

- Almost all the world\'s major stock indices were down

- The reason seems to be the Chinese stock market crash

China bubble

- Chinese bull run was unsustainable -- 300% rise in one year

- The ensuing crash led to panic among investors

- The Chinese govt clamped down, leading to more panic

What next

- Indian markets are much more stable than China

- Dollar flowing out of China may come to India

- Indian investors should remain cautious for the time-being

#Sensex and #BlackMonday trended on Twitter throughout Monday as the Indian stock markets crashed with a thud. The benchmark BSE Sensex closed down 1,624.5 points, losing nearly 6% of its value.

This is its biggest fall since the the 2008 global economic meltdown. Even the more broad-based NSE Nifty mirrored the slide. The Indian equities market, by the way, is not the only one in a bear grip: From the Nikkei in Tokyo to the FTSE 100 in London, all major international indices were in the red on Monday and the US markets looked set to follow suit.

In India, as Rs 7 lakh crore of investors' money got wiped off the charts, Finance Minister Arun Jaitley had to step in to soothe the nerves. "There is not a single domestic factor in India which has either contributed to it or added to it. These are external factors," he said.

Raghuram Rajan, India's rock star central banker, also tried to allay fears by saying there was nothing wrong with the fundamentals of the Indian economy. What is wrong then?

Most fingers point to China, where markets have started tumbling - this morning they fell by over 1,000 points - and the slide could continue.

It was only a matter of time: China's markets had gone up rapidly - by almost 300% in the past one year - and it took just a few weeks to undo that rise.

The message is loud and clear - you can't prop up a market for too long. Looks like China is yet to learn the ways of the market. When the going was good, it allowed speculation to soar and silently watched millions of brokerage accounts being opened in the last 12 months.

Even margin money, much of it from government-owned companies, was used up in trading. The joke was that China suddenly had more trading accounts than the Communist Party had members.

Most of China's 287 million equity trading accounts opened within the last year and are held overwhelmingly by retail punters with sub-high school educations, American businessman and politician David Stockman said in his 16 August newsletter, The Great China Ponzi.

In less than 12 months they took down more than $1 trillion of margin debt through official brokerage channels and a massive network of shadow banking sources "including dodgy peer-to-peer lending arrangements", Stockman pointed out.

The bubble expanded the stock market by $3 trillion in just 60 sessions before panic struck and the same $3 trillion evaporated in just 20 trading days.

And when things started going wrong, China did the worst things that the market would tolerate: It tried to freeze trading, preventing almost a third of the companies from selling in the markets. This made people panic even more.

"Over the long run, economics and markets generally ARE more powerful than the government," a JP Morgan report pointed out, quoting Michael Cembalest's Eye on the Market.

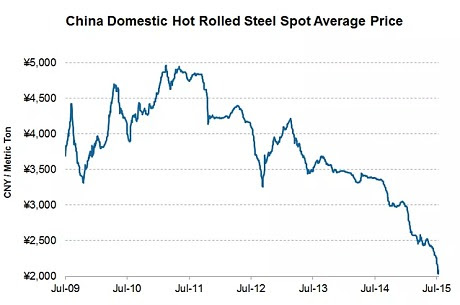

What is actually happening is that China is suffering from a gargantuan investment overhang. A good indicator is the way it used up steel:

Neither China, nor the world can use that much steel. Once China's construction boom stops and the rest of the world erect trade barriers against the country's giant steel mills will be idled. The economic void will will cause a collapse of business, employment and incomes," said Stockman.

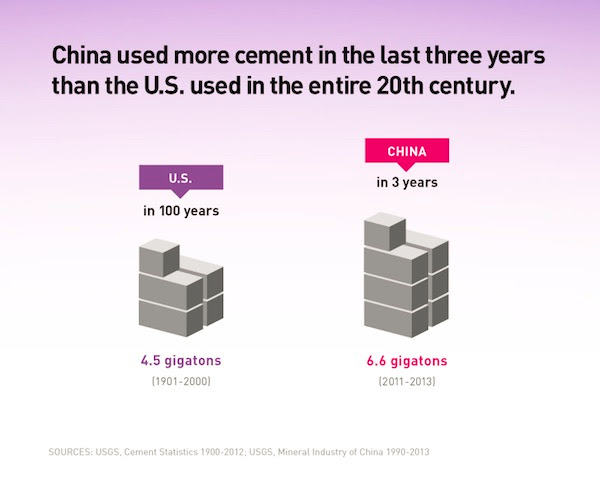

In three recent years China used up more cement than the United States of America did in a century, he pointed out, adding that the country's construction infrastructure is grotesquely overbuilt from cement kilns, to construction equipment manufacturers and distributors, to sand and gravel movers, to construction site vendors of every stripe.

"It's too late for a soft landing and managed deflation of the Great China Ponzi," according to Stockman. "In their heedless resort to the printing press and credit-driven expansion over and over during the past two decades, they have generated freakish impossibilities throughout the length and breadth of the Chinese economy."

More pain can follow because of the manner in which China continues to respond to the crisis. In sharp contrast to India, China has asked its pension funds to put 30% of their money into stock markets to prop them up.

Despite Monday's slump, Indian pension funds regulator has clearly stated that if no profits in investments are visible, pension funds would prefer to sit on their money and wait it out. China's regulators do not have the luxury of saying 'no'.

JP Morgan doesn't expects China's GDP to grow more than 3-4% by the end of this decade. What this augurs is a further run on China's markets, and a further slippage of India's market in sympathetic reaction.

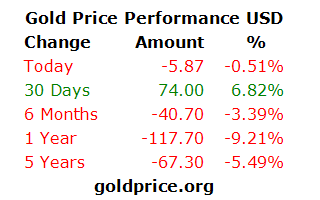

Will this lead to a financial crisis as in 2008? It is too early to tell. But the first signs of panic and a lack of confidence in global economies and currencies can be seen in the way gold has - once again - become important for investors - it has gained 6.8% in the last 30 days, compared with a 3.4% fall in six months.

Does this mean that gold prices will climb? Maybe yes. But then gold too could be an asset bubble. Its recent performance has not been much to write home about.

Clearly, even gold does not lend confidence at this stage. It will also be buffeted around as fierce tempestuous winds of speculation sweep across stock markets.

The silver lining is that India could begin to attract investible dollars that are being pulled out of the Chinese markets. But India's legislators have blocked reform, and even halted policy formation.

In moves that only remind us of "cutting the nose to spite the face" India has failed to inspire confidence. Hopefully, some legislative sense will prevail, and India could fortify itself better.

Otherwise, the picture is quite uncertain. More blood is expected on the streets in the coming days. So fasten your seat belts, hug your knees, and just hunker down till this mad typhoon blows over.

First published: 24 August 2015, 8:22 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](https://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](https://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)