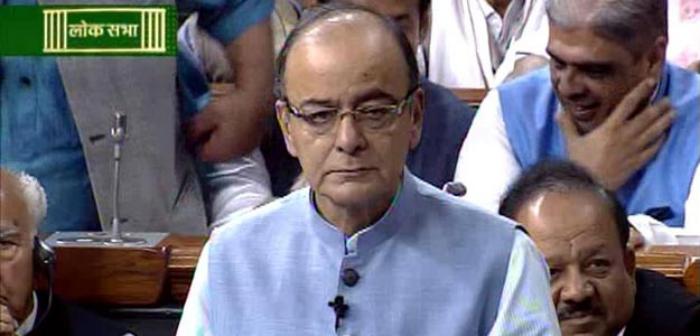

Sector specific measures will be taken to deal with decline of NPAs, says Arun Jaitley

Union Finance Minister Arun Jaitley on 15 March, 2017 said it is a challenge to deal with the Non Performing Assets (NPAs) of the banks, which have witnessed a decline in the last quarter of the current financial year.

Reiterating the core problems during his opening remarks on 15 March, 2017 at the first meeting of the Consultative Committee attached to the Ministry of Finance, Jaitley said the NPAs have expanded their capacity during the boom period (2003-08) but could not face the onslaught of global financial crisis and consequent slow down thereafter.

He said that the government is taking sectoral specific measures to deal with the problem of NPAs specifically in the resolution of large debts.

Jaitley further said that the Reserve Bank of India (RBI) has also made an Oversight Committee to look into process of the cases referred to it by different banks.

Seeing the response and its performance, he said the government is considering multiplication of such committees. On the issue of setting-up a 'bad bank', he said that several possible alternatives exist and the issue is being debated on public platforms.

Talking about the power sector, he said that measures have been taken in introduction of the Ujjwal DISCOM Assurance Yojana (UDAY), auction of natural gas for stranded gas power projects, and allocation of more than 100 coal mines to private and government companies through reverse e-auction.

However, the National Highways Authority of India (NHAI) has in the road sector approved premium recast of 14-15 distressed road projects, new structures such as Hybrid Annuity Model and Toll-Operate-Transfer Model have been introduced and steps taken to fast track environmental clearance process.

The RBI has also taken measures such as Joint Lenders' Forum (JLF) to be compulsorily formed when aggregate exposure is more than Rs. 100 crore, Flexible Structuring (5/25) Scheme for infrastructure and core industries sector based on economic life of the project with periodic refinancing, Strategic Debt Restructuring (SDR) Scheme and Scheme for Sustainable Structuring of Stressed Assets (S4A) among others.

Other suggestions made at the Consultative Committee meeting included that a special bank may be created where NPAs of all the Public Sector Banks be transferred.

It was also suggested that when the minimum import price on import of specific steel products have been introduced, then the similar exercise should also be undertaken for the raw material being used to produce the finished products so that smaller units are also benefitted.

It was also suggested by some members that there is a need to restore the confidence of the officers of the banks which have been off late adversely affected due to the increasing NPAs.

-ANI

- Cytomegalovirus infection, new post-covid complication; all you need to know

- Goa: Kejriwal promises 300 units of free electricity, waiving off old bills if AAP voted to power

- Monsoon session of Parliament: All-party meeting to be held on July 18

- Mumbai Rain Update: Heavy rains cause severe waterlogging in Sion

- Coronavirus Pandemic: India reports 38,792 new COVID-19 cases, 624 deaths