- This is the last monetary policy meet before the Union Budget is announced in February end.

- Inflation is still within January 2016 target, but faces upward risks as Consumer Price Index (CPI) inflation has been inching up since the third quarter (Q3) of 2015.

The Reserve Bank of India (RBI) is expected to keep the key interest rates unchanged in its sixth bi-monthly policy review meet on Tuesday, Singapore's leading bank DBS said on Monday. In a report on the Indian economy, DBS said:

"As markets stabilise, we expect the Reserve Bank of India to keep the rates on hold on February 2. After a total of 125 basis points rate cuts in 2015, the benchmark repo rate is likely to be held at 6.75% and reverse repo rate at 5.75%".

"Reserve ratios will be left unchanged, we reckon. We see room for 25 basis points cut in March or April if the 2016-17 Budget satisfies the central bank on the government's fiscal consolidation efforts. (A March cut would be an inter-meeting decision)".

Inflation

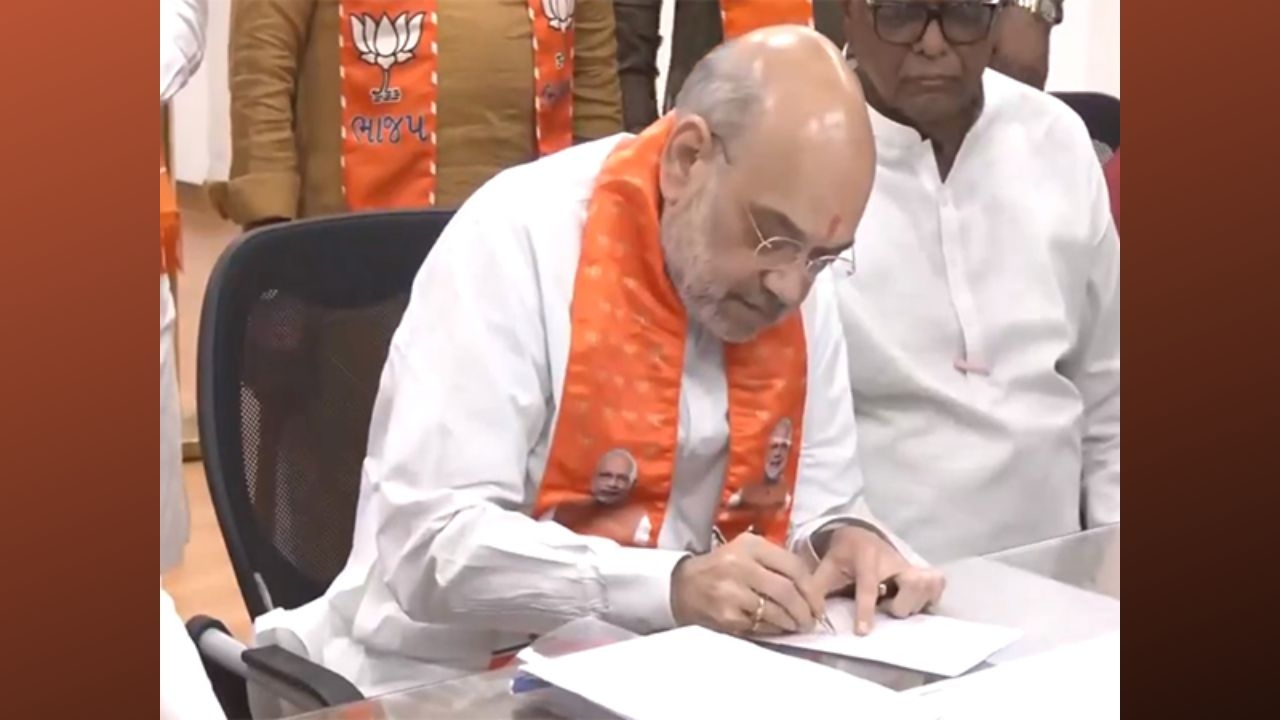

Getty Images

Inflation is still within January 2016 target, but faces upward risks as Consumer Price Index (CPI) inflation has been inching up since the third quarter (Q3) of 2015. From a low of 3.9% year-on-year in the September quarter inflation rose to more than a year's high at 5.6% by December, noted the bank. Core inflation, while still benign, has also tracked the uptrend, it added.

Other price indicators, for instance, Wholesale Price Index (WPI) inflation and Purchasing Managers Index (PMI) sub-indices are also off recent lows, said the bank. The bank pointed out:

"The disinflationary impact of low crude prices was more than offset by a sharp jump in food price pressures and were not helped by adverse base effects".

Service sector inflation remains sticky and indeed rose to 4% year-on-year from 3.1% in the September quarter. Despite the recent increase, the inflation outlook appears manageable, said the bank with a growing presence in the Indian market.

The RBI's inflation target of 6% for January 2016 is unlikely to be breached, it said.

- With agency inputs

First published: 1 February 2016, 1:56 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](http://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](http://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)