Mr Jaitley, backing banks is great. Don't back wilful defaulters politically

The mess

- Public sector banks have been reeling due to falling share prices and declining profits

- At the core of the problem is the bad loans mess the banks have got into

The meeting

- On 6 June, PSU bank managements met the Finance Ministry to create a road map out of the crisis

- After the meeting, Arun Jaitley said the banks would be \'protected constitutionally\'

More in the story

- Why Jaitley also needs to send a message to wilful defaulters

- What banks can learn from the Vijay Mallya and Jatin Mehta cases

In recent times, public sector banks have seen falling share prices and declining profits. And the Ministry of Finance has been trying to send a message to the market that it supports the bank managements' efforts to clean up the bad loans mess.

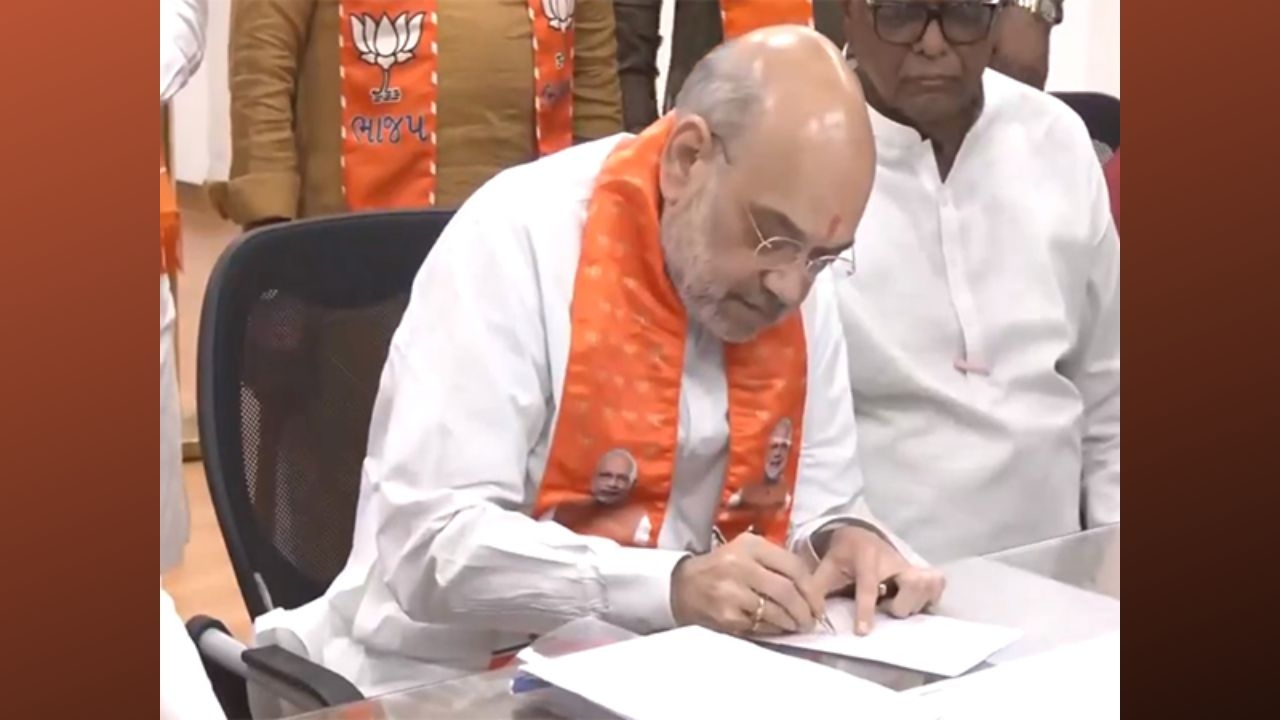

On Monday, 6 June, the ministry and the bankers held a meeting to create a road map for PSU banks. After the meeting, Finance Minister Arun Jaitley said the banks would be 'protected constitutionally to conduct commercially prudent settlement(s)'.

The statement is important, as the issue of bad loans in the Indian banking sector has been created by political interference, and aggravated due to hyper-sentimental outcries from those who do not understand the banking business.

The Mallya example

To understand this, let's take the most popular example - Vijay Mallya - from the bad loan saga.

Mallya had taken loans for his Kingfisher Airlines in 2005. By 2009, he had stopped repaying the loans and got his first Corporate Debt Restructuring (CDR).

Also read: Why we love to hate Vijay Mallya and don't care about other wilful defaulters

Instead of showing his loans as Non-Performing Assets, the banks restructured his loans. Given that Mallya had not started servicing his debt even after getting the CDR, the banks should have declared him a defaulter on their balance sheets.

Yet, it was Mallya's political clout that forced bankers to attempt another CDR, in 2012. It was only after a hue and cry from bank unions that the consortium of lenders had to shut the doors on Mallya. In 2012, Mallya shut his airline services.

It is impossible for any business to get such a long lifeline without a political clout.

How crisis was compounded

The second step - aggravation of the crisis due to a hyper-sentimental public outcry - was also visible in Mallya's case.

After fleeing to London to escape any legal action against him, Mallya made an offer to settle his debts by paying Rs 4,000 crore by September this year, which was 66% of the principal amount.

But due to public pressure, banks decided to go for an 'all or nothing' approach, which often gets 'nothing' in the banking sector, especially if the defaulter has managed to flee to another country.

Also read: The Offering: Mallya says he can repay Rs 4,000 crore. Banks, be smart & accept

Under normal circumstances, any bank would lap the first opportunity to settle a loan amount that turned bad seven years ago. But the management of the public sector banks is afraid of taking decisions that can be questioned by the CBI or the Central Vigilance Commission later.

Follow words with actions

If the Central government promises constitutional backing to public sector banks, the bad loan mess can be cleaned up faster.

But helping the banks deal with bad loans needs one more message from the government. That message should directly go to the defaulters - that none of them will be spared if they have defaulted wilfully.

Alas! So far, the message given by the government is the opposite. Almost everyone interested in the bad loan issues of the Indian banks knew that Mallya was trying to flee the country. Yet, the government did not take requisite action to stop Mallya from taking a flight to London.

Apart from Mallya, another businessman, Jatin Mehta, the promoter of Winsome Diamonds, has fled the country with his wife Sonia, having taken up the citizenship of the tax haven St Kitts and Nevis.

Must read: Why Adani's kin Jatin Mehta gave up Indian citizenship for a tax haven

Strong words have to be followed by strong actions. There are over 5,000 wilful defaulters who owe around Rs 56,000 crore to the Indian banking system.

The government should ensure tough action against all of them, to make sure those who are not in the list of wilful defaulters make every effort to repay their loans.

Otherwise, meeting the managements of public sector units is an old governmental exercise. It usually does not yield any results.

Edited by Shreyas Sharma

First published: 7 June 2016, 3:34 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](http://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](http://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)